AI could make it harder to get a job in finance, but recent graduates say it might also alleviate the burden of entry-level “grunt work” and pave the way for a more fulfilling career.

If you're aspiring to a career in finance, it can be disheartening to see media reports warning that entry-level finance jobs will be eliminated by AI.

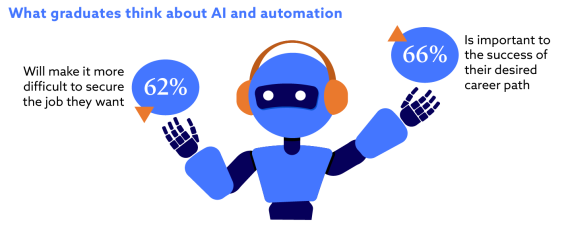

Nearly two-thirds of respondents to CFA Institute’s 2024 Graduate Outlook Survey believe artificial intelligence (AI) and automation will make it more difficult to secure the job they want.

But there is a more nuanced view of the role of AI in the financial industry. AI needs humans to set goals, write programs, train algorithms, check data quality and interpret the results. Recent graduates and university finance students accept that the technology will reshape some jobs, but they do not expect it to render them obsolete.

Only 13% of the students and graduates responding in the CFA Institute survey think AI will make it significantly more difficult to land the job they want – the rest think it will just make it slightly more difficult.

“I’m not as concerned as many people are because I think AI is a very useful tool, but I don't think it will be able to substitute a human's experience, a human's sense of the world and how everything works,” said Isabela Mascarenhas Belém de Faria, a director at Brazilian investment management firm CJE-FGV, who pursued a Bachelor’s in Economics at FGV EESP.

Hugo Heanly, a recent graduate with a Bachelor of Finance and Bachelor of Science from the Australian National University, shares this view.

“I don't think it's going to be as disruptive as everyone believes,” he said. “I think it'll certainly automate processes: basic financial analysis of companies, the provision of decks or materials for meetings. But the real ‘people part’ of finance – I believe that's something that's going to be much later down the track to be replaced.”

Transforming work

The ability of AI to handle low-level but important tasks will allow businesses to place a premium instead on their employees’ uniquely human skills, such as creativity, originality, leadership and collaboration.

By streamlining workflows and automating repetitive manual tasks, AI can give us more opportunity to use “our unique brain power to solve issues,” said Chen Huan Liu, a Private Equity Analyst at Crescent Capital Partners, who graduated with a Bachelor of Actuarial Studies from the Australian National University. This could potentially lead to more creative solutions, she added.

AI in finance may have greater implications for recent hires. According to Moritz Habetha, who is studying International Business Administration at WHU – Otto Beisheim School of Management and completed an investment banking internship at Commerzbank, by automating mundane manual processes, AI “presents a great opportunity for new people getting into this to really start working on substantial things and not just formatting PowerPoint slides and Excel tables.”

Of course, by automating these tasks, “I do see it replacing jobs at the lower level,” said Liam Newport, an investment banking analyst at Gresham Partners who graduated from the Australian National University with a Bachelor of Finance and Bachelor of Economics, Capital Markets. “Its ability to pull numbers and do essentially grunt work is improving month on month.”

Must-have skills

As investment firms incorporate data science and AI into almost everything they do, a 2022 CFA Institute report revealed that the most in-demand talent across firms is finance professionals with AI and big data skills. Respondents to the 2024 Graduate Outlook Survey recognize this: two-thirds consider AI and automation as important to the success of their desired career path, and over 90% believe knowing how to use these tools would benefit their career prospects.

“Staying up to date on what's going on with AI and understanding the most efficient ways to incorporate it into your work will end up being a very helpful tool,” said Arnav Sheth, who is studying Accounting and Financial Management at University of Waterloo.

Instead of fearing AI’s inexorable advance across the investment process, many students and graduates welcome it, and look forward to experiencing first-hand how it is transforming their chosen field.

“We're still slowly implementing it, but I'm really hoping that as it increases in usage and technological ability, it will revolutionize the industry,” said Aryaman Dhillon, an investment banking analyst at Agentis Capital, who is pursuing a Bachelor of Computing and Financial Management, Computer Science, Accounting and Finance at University of Waterloo.

“I find it very exciting and fascinating to see where it can take the entire space,” he said.

Discover more: read the full series

You may also be interested in

Explore our programs and certificates

CFA Institute offers a diverse range of programs and certificates designed to meet the needs of finance professionals across various career stages and specializations.